-

Metalworking Machinery

brake, roll and shear combination machines (3 products)

brake, roll and shear combination machines (3 products) press brakes (15 products)

press brakes (15 products) sheet metal brakes (30 products)

sheet metal brakes (30 products) sheet metal shears (22 products)

sheet metal shears (22 products) slip & plate rolls (14 products)

slip & plate rolls (14 products) combination mill drill lathe (1 products)

combination mill drill lathe (1 products) drill presses (31 products)

drill presses (31 products) mill drills (6 products)

mill drills (6 products) metal lathes (57 products)

metal lathes (57 products) radial drills (2 products)

radial drills (2 products) drill, mill, and lathe accessories (2 products)

drill, mill, and lathe accessories (2 products) air filtration (1 products)

air filtration (1 products) metalworking dust collection (6 products)

metalworking dust collection (6 products) bead rollers (3 products)

bead rollers (3 products) lockformer (1 products)

lockformer (1 products) power hammers and english wheels (2 products)

power hammers and english wheels (2 products) shrinker/stretchers (2 products)

shrinker/stretchers (2 products) forming and shaping tooling and accessories (1 products)

forming and shaping tooling and accessories (1 products) beveling and deburring (2 products)

beveling and deburring (2 products) finishing (8 products)

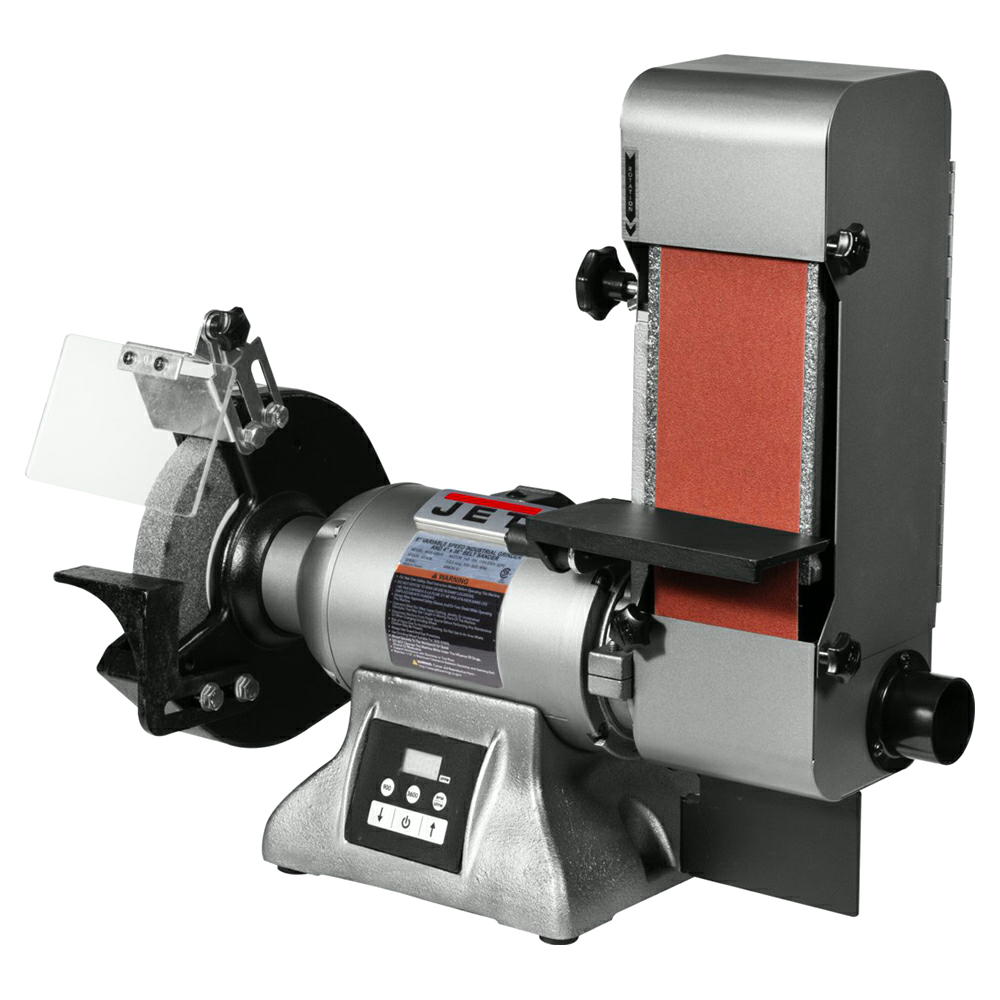

finishing (8 products) grinding (17 products)

grinding (17 products) grinding and finishing accessories (3 products)

grinding and finishing accessories (3 products) ironworkers and punches (43 products)

ironworkers and punches (43 products) notchers (22 products)

notchers (22 products) plasma cutters (5 products)

plasma cutters (5 products) plasma tables (4 products)

plasma tables (4 products) hydraulic presses (5 products)

hydraulic presses (5 products) c-frame presses (2 products)

c-frame presses (2 products) h-frame presses (2 products)

h-frame presses (2 products) shop and air presses (7 products)

shop and air presses (7 products)

metalworking abrasive saws (1 products)

metalworking abrasive saws (1 products) metalworking cold saws (11 products)

metalworking cold saws (11 products) metalworking horizontal bandsaw (53 products)

metalworking horizontal bandsaw (53 products) metalworking vertical bandsaw (14 products)

metalworking vertical bandsaw (14 products) saw blades, discs & accessories (1 products)

saw blades, discs & accessories (1 products) strut cutters kits (1 products)

strut cutters kits (1 products) exhaust and hydraulic benders (2 products)

exhaust and hydraulic benders (2 products) mandrel benders (1 products)

mandrel benders (1 products) roll benders (10 products)

roll benders (10 products) rotary draw benders (11 products)

rotary draw benders (11 products) water jets (1 products)

water jets (1 products) wilton shears (1 products)

wilton shears (1 products) -

Woodworking Machinery

- Air Compressors

- Clamps

- CNC Routers

- Combination Machines

- Dovetail Machines

- Downdraft tables

- Drawer Notcher

- Drill Presses

- Drilling, Doweling and Boring

- Dust Collectors and Air Filtration Systems

- Edgebanders

- End Matchers

- Faceframe Tables

- Hydraulic Scissor Lifts

- Jointers

- Lathes

- LED Worklights

- Material Handling Systems

- Measuring Systems

- Molders

- Mortisers

- Planers

- Power Feeders

- Sanders

- Saws

- Semi-automatic Glue and Dowel Machines

- Shapers

- Spray Machines

- Tenoners

air compressors (13 products)

air compressors (13 products) air compressor accessories (4 products)

air compressor accessories (4 products) clamps (44 products)

clamps (44 products) combination machines (4 products)

combination machines (4 products) dovetail machines (4 products)

dovetail machines (4 products) drawer notcher (3 products)

drawer notcher (3 products) drill presses (9 products)

drill presses (9 products) drilling, doweling and boring (288 products)

drilling, doweling and boring (288 products) boring machines (14 products)

boring machines (14 products)

hinge boring machines (241 products)

hinge boring machines (241 products) dust collectors and air filtration systems (324 products)

dust collectors and air filtration systems (324 products) down draft sanding tables (48 products)

down draft sanding tables (48 products) dust collectors (228 products)jpw industries air filtration systems (2 products)

dust collectors (228 products)jpw industries air filtration systems (2 products) edgebanders (48 products)

edgebanders (48 products) end matchers (1 products)

end matchers (1 products) hydraulic scissor lifts (2 products)

hydraulic scissor lifts (2 products) jointers (53 products)

jointers (53 products) lathes (48 products)

lathes (48 products) led worklights (7 products)

led worklights (7 products) material handling systems (80 products)

material handling systems (80 products) molders (4 products)

molders (4 products) mortisers (10 products)

mortisers (10 products) planers (55 products)

planers (55 products) power feeders (56 products)

power feeders (56 products) sanders (154 products)combination disc and belt sanders (8 products)

sanders (154 products)combination disc and belt sanders (8 products) disc sanders (2 products)

disc sanders (2 products) drum sanders (29 products)

drum sanders (29 products) edge sanders (17 products)

edge sanders (17 products) sanding tables (21 products)

sanding tables (21 products) spindle sanders (4 products)

spindle sanders (4 products) wide belt sanders (32 products)

wide belt sanders (32 products) bandsaws (54 products)

bandsaws (54 products) cut-off/chop saws (15 products)

cut-off/chop saws (15 products) panel saws (32 products)

panel saws (32 products) radial arm saws (5 products)

radial arm saws (5 products) rip saws (7 products)

rip saws (7 products) sawstop (57 products)

sawstop (57 products) table saws (91 products)

table saws (91 products) tigerstop (118 products)

tigerstop (118 products) vertical saws (26 products)

vertical saws (26 products) semi-automatic glue and dowel machines (7 products)

semi-automatic glue and dowel machines (7 products) shapers (36 products)

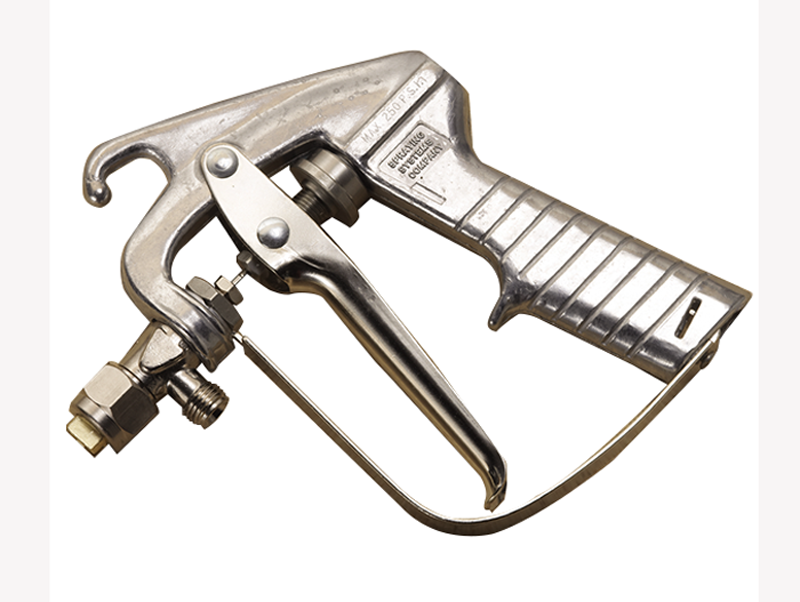

shapers (36 products) spray machines (17 products)

spray machines (17 products) spray machine accessories (16 products)

spray machine accessories (16 products) tenoners (1 products)

tenoners (1 products) -

Woodworking and Shop Supplies

- Abrasives

- Adhesives, Caulking & Sealants

- Bathroom Hardware & Accessories

- Catches & Locks

- Decorative Hardware & Wood Components

- Drawer Slides & Systems

- Fasteners & Assembly Fittings

- Finishing Products & Equipment

- Hand Tools & Clamps

- Hinges and Lift Systems

- Kitchen Hardware & Accessories

- Knobs & Pulls

- Laminate, Panels and Edgebanding

- Lighting

- Office & Furniture Hardware

- Power Tools, Air Tools & Accessories

- Shelf & Closet Hardware

- Shop Supplies & Safety Equipment

- Sinks & Faucets

- Tooling

accessories (22 products)

accessories (22 products) backing pads (128 products)

backing pads (128 products) belts (369 products)

belts (369 products) discs (912 products)

discs (912 products) pads & sponges (126 products)

pads & sponges (126 products) rolls (110 products)

rolls (110 products) sheets (217 products)

sheets (217 products) specialty abrasives (229 products)

specialty abrasives (229 products) adhesive guns (14 products)

adhesive guns (14 products) adhesive hoses (21 products)

adhesive hoses (21 products) adhesives (504 products)

adhesives (504 products) caulking & sealants (289 products)

caulking & sealants (289 products) solvents (12 products)

solvents (12 products) spray accessories (14 products)

spray accessories (14 products) wood fillers & putty (166 products)

wood fillers & putty (166 products) bathroom stall hardware (129 products)

bathroom stall hardware (129 products) curling iron & hair dryer holders (14 products)

curling iron & hair dryer holders (14 products) pull out organizers (7 products)

pull out organizers (7 products) racks & towels bars (337 products)

racks & towels bars (337 products) robe hooks (128 products)

robe hooks (128 products) undersink drip trays (4 products)

undersink drip trays (4 products) bar railings (82 products)

bar railings (82 products) block & spools (10 products)

block & spools (10 products) columns (291 products)

columns (291 products) corbels (408 products)

corbels (408 products) decorative fillers & caps (66 products)

decorative fillers & caps (66 products) decorative grills & lattices (44 products)

decorative grills & lattices (44 products) feet (125 products)

feet (125 products) hardwood dowels (4 products)

hardwood dowels (4 products) island turnings (225 products)

island turnings (225 products) moldings (221 products)

moldings (221 products) onlays (18 products)

onlays (18 products) rosettes (2 products)

rosettes (2 products) switch & outlet plates (57 products)

switch & outlet plates (57 products) tag holders (1 products)

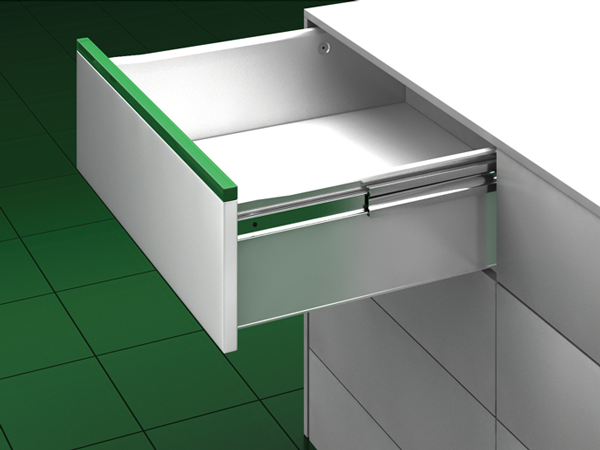

tag holders (1 products) drawer box systems (921 products)

drawer box systems (921 products) drawer materials (73 products)

drawer materials (73 products) drawer organizers (1 products)

drawer organizers (1 products) drawer slides (1809 products)

drawer slides (1809 products) drawer slides and systems accessories (139 products)

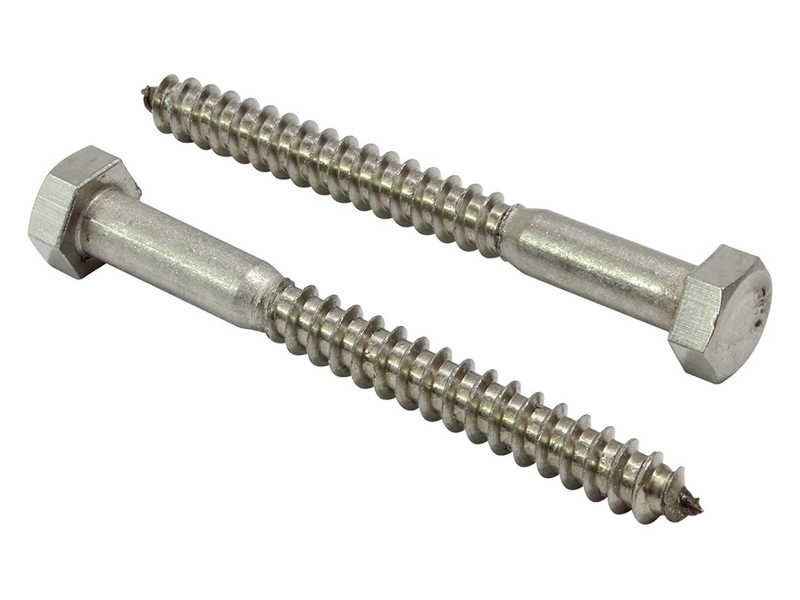

drawer slides and systems accessories (139 products) screws (2309 products)

screws (2309 products) nails (81 products)

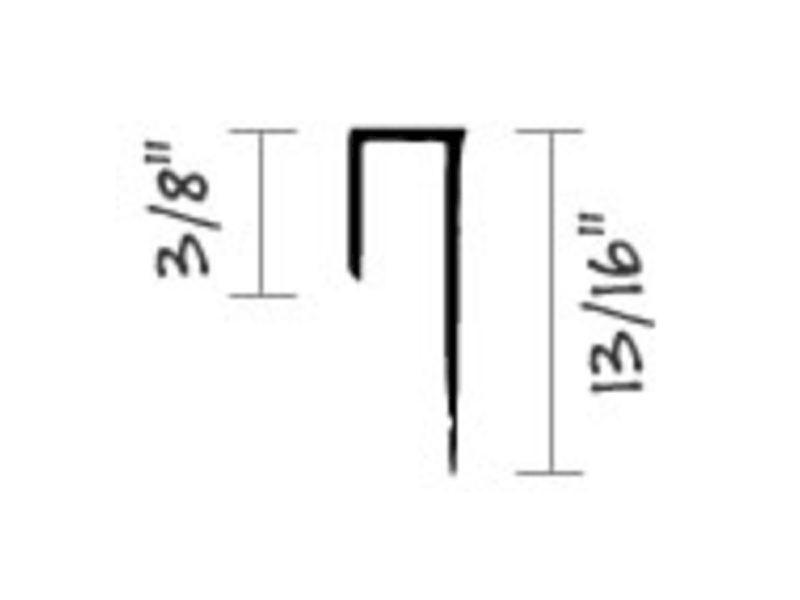

nails (81 products) staples (52 products)

staples (52 products) bed rail fasteners (5 products)

bed rail fasteners (5 products) bolts (5 products)

bolts (5 products) brackets & braces (88 products)

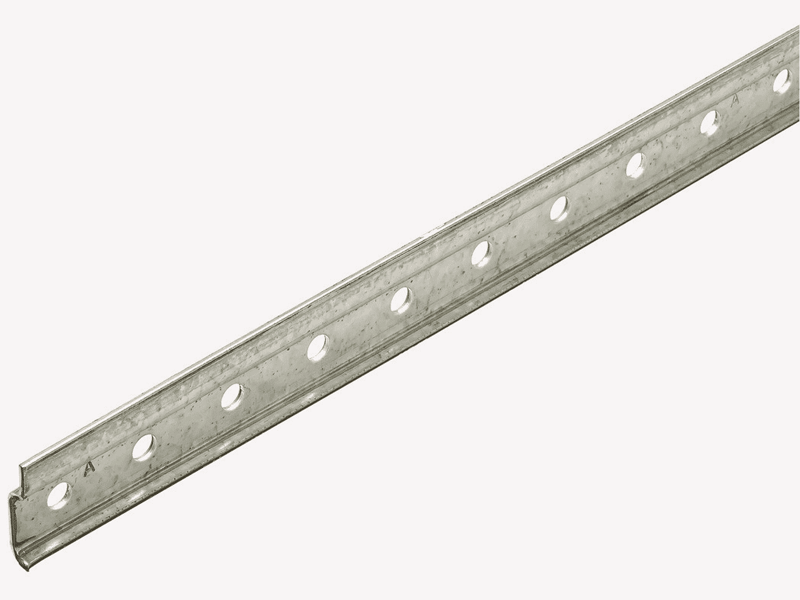

brackets & braces (88 products) cabinet hanging rails (25 products)

cabinet hanging rails (25 products)

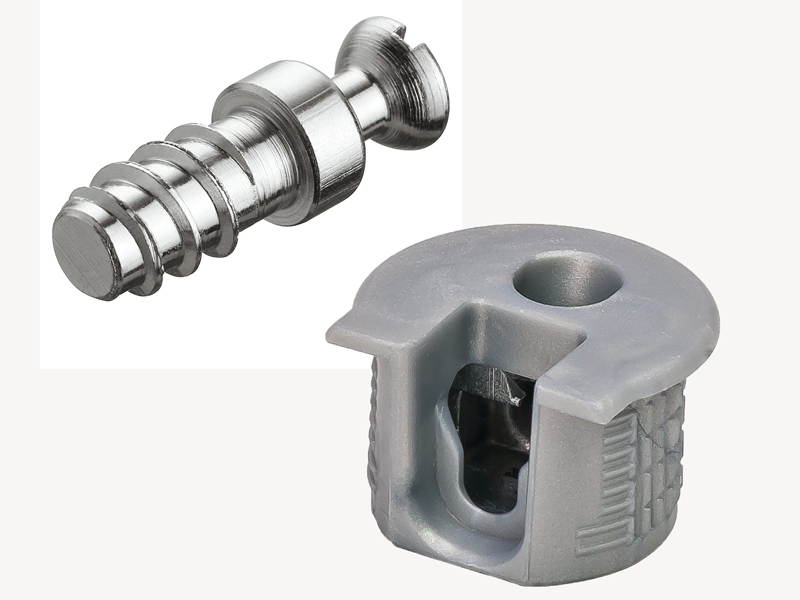

countertop connectors (17 products)

countertop connectors (17 products) covercaps (1328 products)

covercaps (1328 products) drywall anchors (7 products)

drywall anchors (7 products) fastener organizers (1 products)

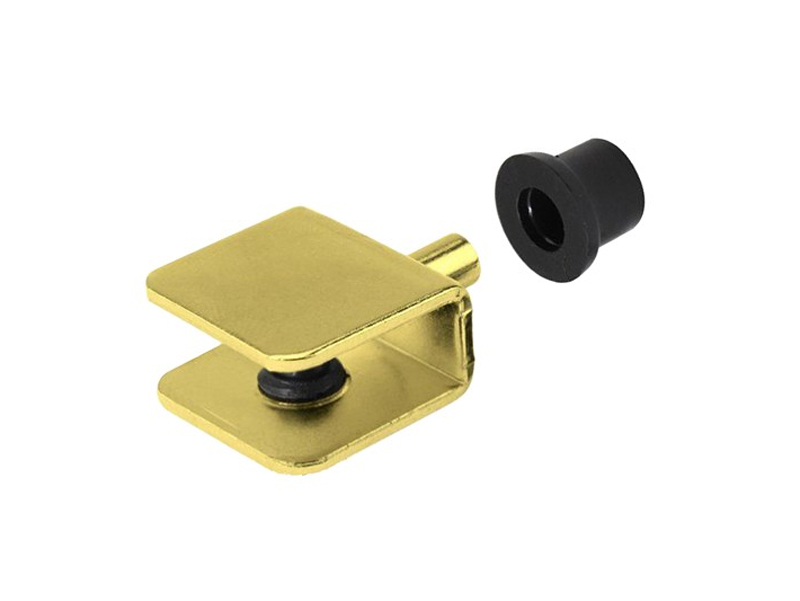

fastener organizers (1 products) grill & glass clips (18 products)

grill & glass clips (18 products) joining biscuits & tenons (102 products)

joining biscuits & tenons (102 products) panel fastening clips (61 products)

panel fastening clips (61 products) plastic dowels & screws for dowels (27 products)

plastic dowels & screws for dowels (27 products) raised panel spacers (36 products)

raised panel spacers (36 products) rta fittings (83 products)

rta fittings (83 products) washers (42 products)

washers (42 products) wood dowel pins & rods (46 products)

wood dowel pins & rods (46 products) wood hole plugs (13 products)

wood hole plugs (13 products) chemcraft systems (555 products)

chemcraft systems (555 products) finishes (196 products)

finishes (196 products) glazes (14 products)

glazes (14 products) solvents (187 products)

solvents (187 products) spray systems (481 products)

spray systems (481 products) wood sealers (82 products)

wood sealers (82 products) alignment tools (5 products)

alignment tools (5 products) allen keys (53 products)

allen keys (53 products) chisels, knives & scrapers (27 products)

chisels, knives & scrapers (27 products) clamps (101 products)

clamps (101 products) edge sanding tools (2 products)

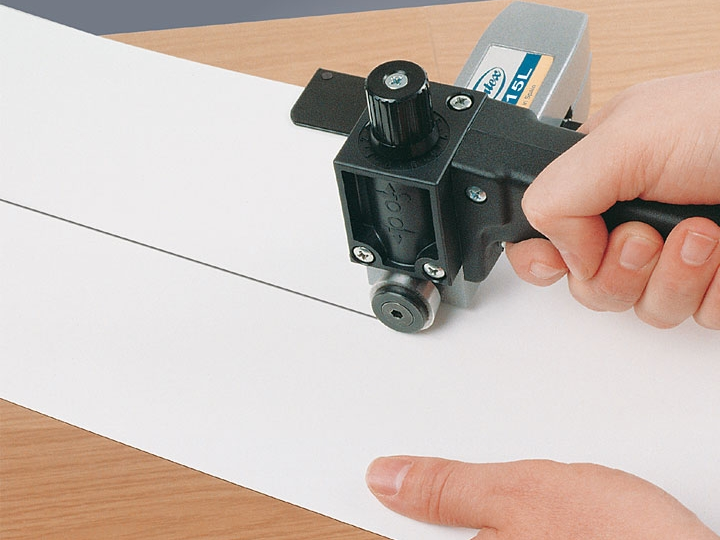

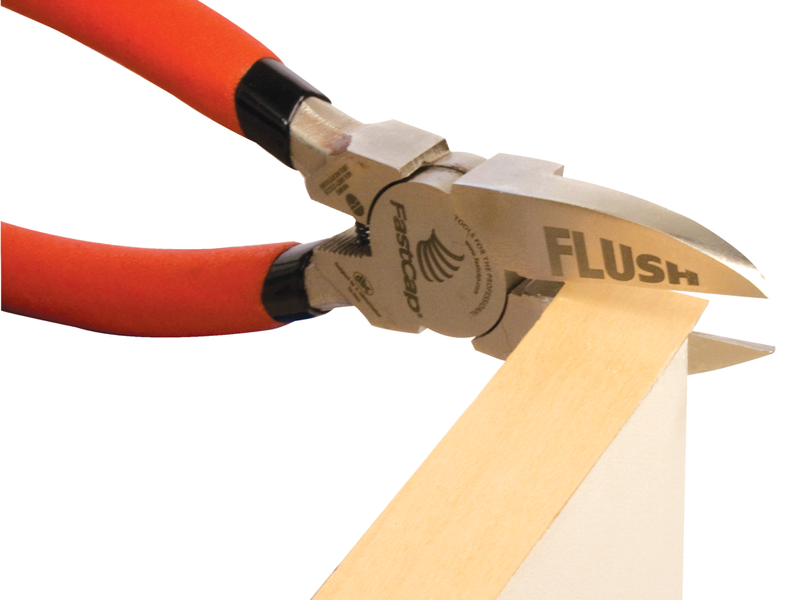

edge sanding tools (2 products) edgebanding & veneer trimmers (13 products)

edgebanding & veneer trimmers (13 products) files & brushes (21 products)

files & brushes (21 products) hammers & mallets (3 products)

hammers & mallets (3 products) hand saws (1 products)

hand saws (1 products) hand tool accessories (33 products)

hand tool accessories (33 products) hanging & assembly tools (2 products)

hanging & assembly tools (2 products) jigs & assembly aids (120 products)

jigs & assembly aids (120 products) pliers & cutters (66 products)

pliers & cutters (66 products) pressure rollers (6 products)

pressure rollers (6 products) ratchets (13 products)

ratchets (13 products) screwdrivers (23 products)

screwdrivers (23 products) seaming tools (2 products)

seaming tools (2 products) sockets (229 products)

sockets (229 products) supports (24 products)

supports (24 products) t-handles (41 products)

t-handles (41 products) tape measures (26 products)

tape measures (26 products) wrenches (121 products)

wrenches (121 products) accessories (113 products)

accessories (113 products) euro hinges (1474 products)

euro hinges (1474 products)

hinges (407 products)

hinges (407 products) lifts & lid stays (279 products)

lifts & lid stays (279 products) appliance garages (53 products)

appliance garages (53 products) appliance lifts (8 products)

appliance lifts (8 products) blind corner units (265 products)

blind corner units (265 products) bread drawers (5 products)

bread drawers (5 products) cabinet accessories (5 products)

cabinet accessories (5 products) cabinets (107 products)

cabinets (107 products) cutlery trays & drawer inserts (232 products)

cutlery trays & drawer inserts (232 products) cutting boards & knife blocks (33 products)

cutting boards & knife blocks (33 products) door storage (49 products)

door storage (49 products) lazy susans (569 products)

lazy susans (569 products) maple butcher blocks & backsplashes (21 products)

maple butcher blocks & backsplashes (21 products) pantry units (32 products)

pantry units (32 products) plate racks (25 products)

plate racks (25 products) pull down shelves (76 products)

pull down shelves (76 products) pull out units (1100 products)

pull out units (1100 products) range hoods (396 products)

range hoods (396 products) sink front trays & hinges (174 products)

sink front trays & hinges (174 products) sink setters (2 products)

sink setters (2 products) spice racks & trays (65 products)

spice racks & trays (65 products) tambour door systems (168 products)

tambour door systems (168 products) trash, waste and recycling (450 products)

trash, waste and recycling (450 products) tray dividers (47 products)

tray dividers (47 products) undersink drip trays (17 products)

undersink drip trays (17 products) wine and stemware racks (179 products)

wine and stemware racks (179 products) aluminum moldings & braces (23 products)

aluminum moldings & braces (23 products) backing sheets (32 products)

backing sheets (32 products) dry erase & tackable boards (7 products)

dry erase & tackable boards (7 products) edge treatments (105 products)

edge treatments (105 products) edgebanding (1279 products)

edgebanding (1279 products) laminates & solid surface panels (9416 products)

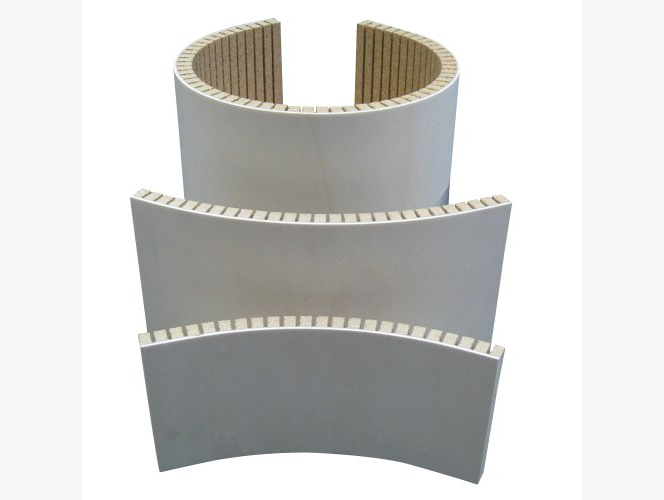

laminates & solid surface panels (9416 products) lightweight panels & bendable boards (151 products)

lightweight panels & bendable boards (151 products) veneers sheets (159 products)

veneers sheets (159 products) bed mechanisms (12 products)

bed mechanisms (12 products) cpu holders (10 products)

cpu holders (10 products) electric trim rings (13 products)

electric trim rings (13 products) grommets & wire management (634 products)

grommets & wire management (634 products) keyboard arms & trays (12 products)

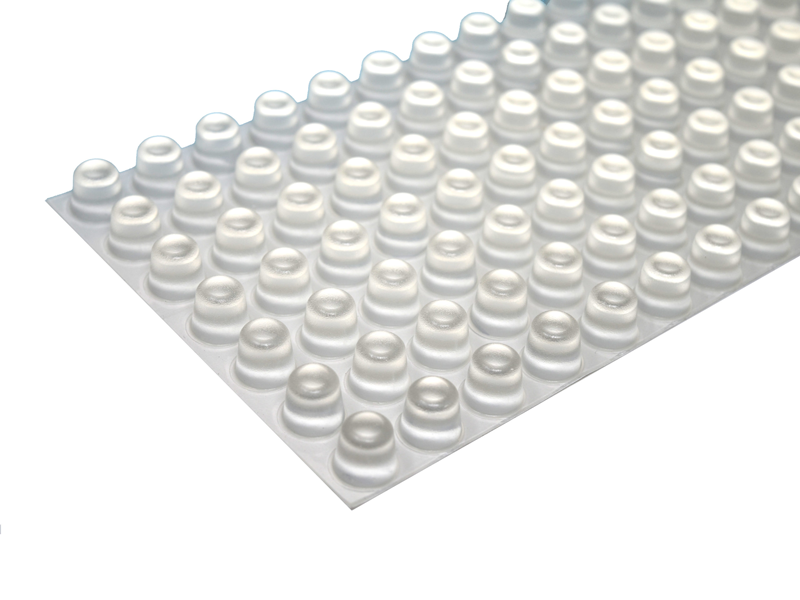

keyboard arms & trays (12 products) leg levelers, casters & glides (440 products)

leg levelers, casters & glides (440 products) pencil drawer trays & slides (1 products)

pencil drawer trays & slides (1 products) swivels (8 products)

swivels (8 products) table & furniture legs (350 products)

table & furniture legs (350 products) toe kicks (26 products)

toe kicks (26 products) accessories for power & air tools (228 products)

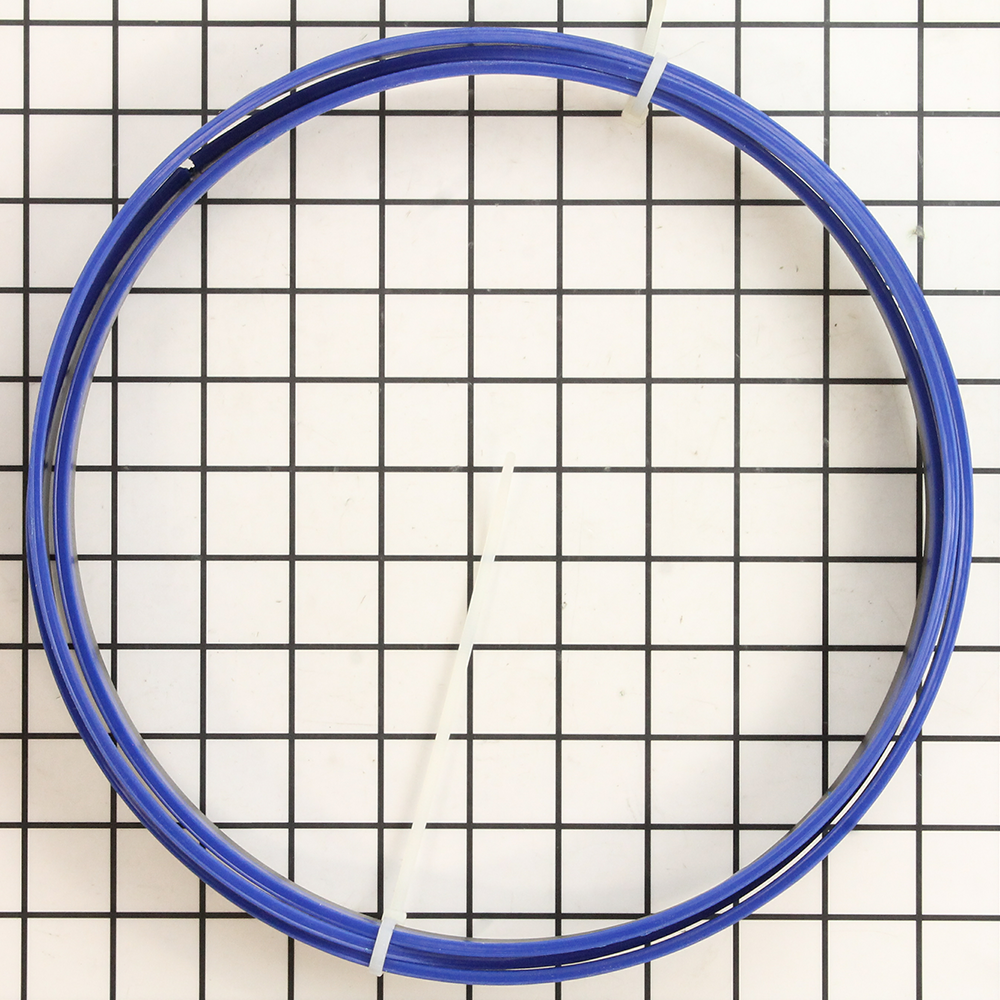

accessories for power & air tools (228 products) air hoses (19 products)

air hoses (19 products) air line accessories (15 products)

air line accessories (15 products) belt sanders (4 products)

belt sanders (4 products) combo kits (9 products)

combo kits (9 products) drills & drivers (34 products)

drills & drivers (34 products) edgebanders, heat guns & hand irons (2 products)

edgebanders, heat guns & hand irons (2 products) hand sanders (112 products)

hand sanders (112 products) laminate trimmers (1 products)

laminate trimmers (1 products) planers (7 products)

planers (7 products) plate & tenon joiners (2 products)

plate & tenon joiners (2 products) portable dust extractors (58 products)

portable dust extractors (58 products) router accessories (72 products)

router accessories (72 products) routers (16 products)

routers (16 products) saws (34 products)

saws (34 products) staplers & nailers (23 products)

staplers & nailers (23 products) closet mirrors (5 products)

closet mirrors (5 products) closet rods, pull down (30 products)

closet rods, pull down (30 products) closet rods, standard (214 products)

closet rods, standard (214 products) closet rods, valet (46 products)

closet rods, valet (46 products) glass shelf hardware (22 products)

glass shelf hardware (22 products) hampers & closet baskets (230 products)

hampers & closet baskets (230 products) hooks & racks (254 products)

hooks & racks (254 products) ironing boards (72 products)

ironing boards (72 products) jewelry trays & liners (34 products)

jewelry trays & liners (34 products) library ladders (389 products)

library ladders (389 products) pant racks (68 products)

pant racks (68 products) pilasters (119 products)

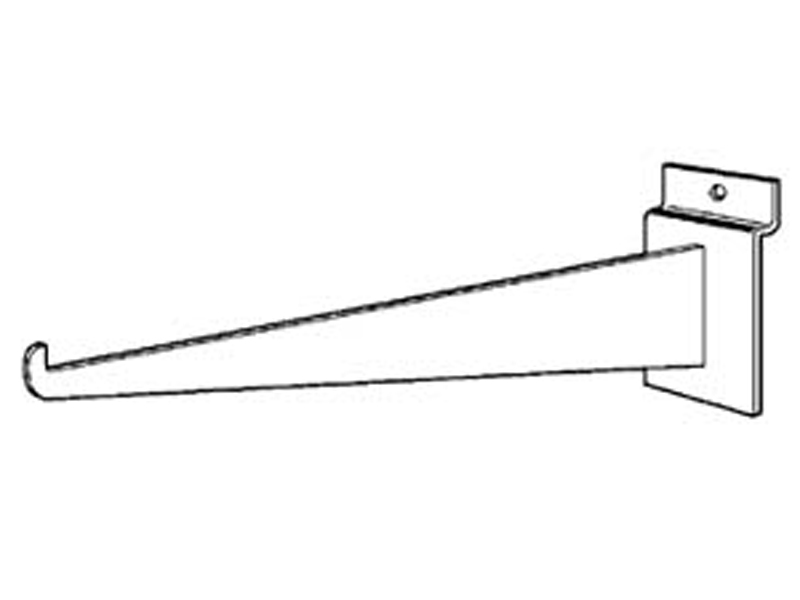

pilasters (119 products) retail display components (1 products)

retail display components (1 products) shelf braces & brackets (420 products)

shelf braces & brackets (420 products) shelf pins & supports (233 products)

shelf pins & supports (233 products) shelves (68 products)

shelves (68 products) shoe storage (33 products)

shoe storage (33 products) slatwall brackets (33 products)

slatwall brackets (33 products) sliding door hardware (550 products)

sliding door hardware (550 products) standards & brackets (390 products)

standards & brackets (390 products) tie, belt & scarf racks (74 products)

tie, belt & scarf racks (74 products) utility hooks (8 products)

utility hooks (8 products) aprons (8 products)

aprons (8 products) back supports (3 products)

back supports (3 products) batteries (8 products)

batteries (8 products)

brooms (7 products)

brooms (7 products) brushes & paint supplies (40 products)

brushes & paint supplies (40 products) caps (1 products)

caps (1 products) cleaners (22 products)

cleaners (22 products) drink coolers, beverages & supplies (23 products)

drink coolers, beverages & supplies (23 products) empty bottles, lids & cans (60 products)

empty bottles, lids & cans (60 products) eye protection (48 products)

eye protection (48 products) fans (3 products)

fans (3 products) fire extinguishers (6 products)

fire extinguishers (6 products) first aid & emergency equipment (14 products)

first aid & emergency equipment (14 products) gloves (102 products)

gloves (102 products) hearing protection (14 products)

hearing protection (14 products) janitorial & sanitation supplies (31 products)

janitorial & sanitation supplies (31 products) knee pads (1 products)

knee pads (1 products) literature (1 products)

literature (1 products) lubricants (20 products)

lubricants (20 products) magnets (3 products)

magnets (3 products) packing & shipping supplies (23 products)

packing & shipping supplies (23 products) paint & glue rollers (11 products)

paint & glue rollers (11 products) power cords & shop lighting (21 products)

power cords & shop lighting (21 products) respiratory protection (74 products)

respiratory protection (74 products) safety cloths (37 products)

safety cloths (37 products) shims (8 products)

shims (8 products) shop carts & dollies (23 products)

shop carts & dollies (23 products) shop rags & blankets (22 products)

shop rags & blankets (22 products) signs (4 products)

signs (4 products) step stools (2 products)

step stools (2 products) tapes (83 products)

tapes (83 products) temperature indicating liquids (3 products)

temperature indicating liquids (3 products) tool bags (8 products)

tool bags (8 products) velcro (4 products)

velcro (4 products) writing & marking supplies (6 products)

writing & marking supplies (6 products) accessories for sinks (92 products)

accessories for sinks (92 products) acrylic sinks (67 products)

acrylic sinks (67 products)

edge sinks (7 products)

edge sinks (7 products) faucets (73 products)

faucets (73 products) quartz sinks (331 products)

quartz sinks (331 products) stainless steel sinks (114 products)

stainless steel sinks (114 products) drill bits (687 products)

drill bits (687 products) driver bits (444 products)

driver bits (444 products) hole saws (15 products)

hole saws (15 products) insert knives (104 products)

insert knives (104 products) planer blades (15 products)

planer blades (15 products) plug cutters (9 products)

plug cutters (9 products) replacement blades (10 products)

replacement blades (10 products) router bits (2615 products)

router bits (2615 products) saw blades (412 products)

saw blades (412 products) -

Quick Order

Quick Order List✕Input your items below (or) upload in bulk from a .csv file.